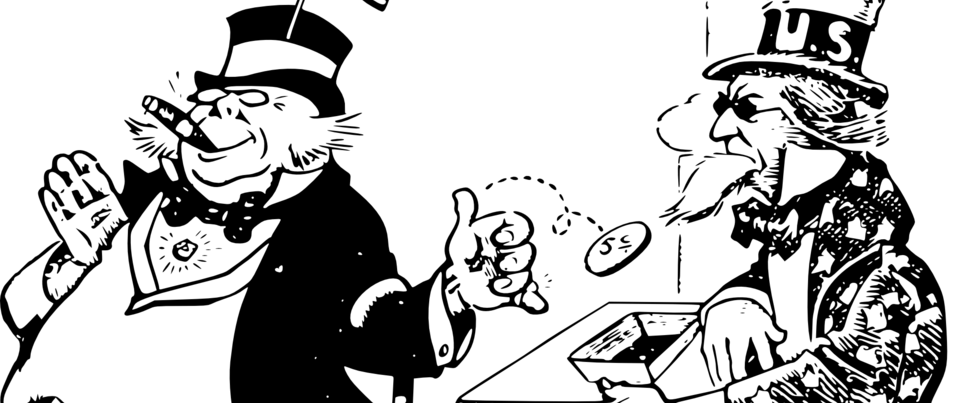

Our friends over at The Motley Fool (a financial services company) are questioning a loophole that allows wealthy working people to avoid paying Social Security Payroll Taxes on income over $128,400.

Here’s how the rich have sidestepped paying $149 billion in Social Security tax

One of the presumed easiest way to resolve Social Security’s imminent cash crunch is to raise more revenue. And the easiest way to do that would be to adjust its most important source of income: the 12.4% payroll tax on earned income.

In 2017, Social Security’s payroll tax provided $873.6 billion of the $996.6 billion collected by the program. As time passes and the interest income Social Security earns from its asset reserves dwindles, the payroll tax is expected to play an even more important role in generating revenue to be disbursed to eligible beneficiaries.

But there’s just one catch that I haven’t yet mentioned: This 12.4% payroll tax only applies up to a certain wage income level. In 2018, that level is $128,400. Though this figure tends to adjust in-step with the National Average Wage Index (NAWI) each year — it remains unchanged in years where no cost-of-living adjustment is passed along, even if the NAWI has shown a positive increase — it means the rich will be exempted from Social Security’s payroll tax on their earned income above $128,400 this year.

To learn more about this issue and other issues of importance to Senior Citizens, please visit us at The Seniors Center, on Facebook, or on Twitter.