I’m newly retired and I received two letters from SS. The first stated my monthly “benefit” payment, the second stated that there had been an error and my monthly “benefits” were being lowered by over $50.00 per month due to “national wage averaging,” and that my individual contributions were not used to calculate my monthly “benefit.”

My questions are: What is “national wage averaging” and when was it made a “law” that my personal contributions were no longer valid to figure my monthly reimbursement, that I have to be penalized due to the fact that I earned MORE than the national wage average?

Clarissa S.

Hi, Clarissa,

Congratulations on your retirement!

This is an excellent question.

Most people have a vague understanding about how Social Security benefits are determined: the Social Security Administration (SSA) looks at your 35 highest earning years and your age at retirement and ultimately bases your monthly benefit amount on those two factors.

While those are the most critical factors in the determination, Social Security benefit calculations are a little more complicated than that. It’s likely many people–especially the newly or soon-to-retire–aren’t familiar with the National Average Wage Index (NAWI) and how it can affect their benefit payments.

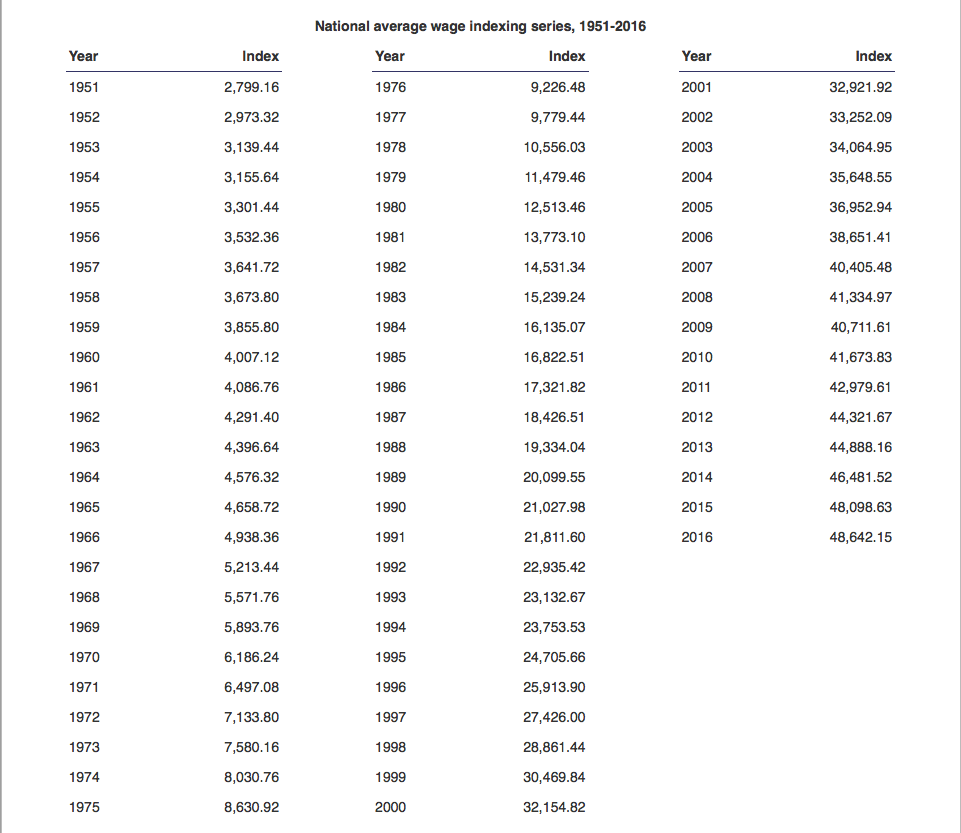

The NAWI is an index calculated by the SSA each year to indicate workers’ average wages across the country. It’s a helpful tool for a variety of reasons–it can show the Federal Reserve and lawmakers how wage trends shift from year to year, for example. The NAWI measures wage inflation, which in turn tells the Federal Reserve whether it should raise or lower interest rates to influence the economy to get wages where they need to be.

But the number one way it’s used is to index a worker’s earnings to determine their Social Security benefit. This is to make sure that worker’s benefit will reflect the standard of living increases that occurred while he or she was working.

To get the NAWI, the previous year’s index is multiplied by the percent change in wage averages between the previous year and the current year.

To make that a little easier to understand, the NAWI calculation for 2018 would look something like this:

2017’s NAWI x (2018’s average wage / 2017’s average wage) = 2018’s NAWI

Before determining your Average Indexed Monthly Earnings (AIME) for your 35 top earning years, the SSA indexes your earnings to the NAWI that was calculated the year you turned 60.

Bear with us here–this is going to get a little math-y.

The basic formula is this: take the NAWI from the year you turned 60 and divide it by the NAWI from the year you want to index to get an “index factor.” Then, you multiply the index factor by your earnings for that year you’re trying to index.

Suppose you turned 60 in 2010. The NAWI for 2010 was $41,673.83. Let’s also suppose we’re trying to index your wages for 1985 when you earned $25,000. The NAWI in 1985 was $16,822.51. This is what your indexed wages for 1985 would look like:

$41,673.83 / $16,822.51 = 2.47 (this number is your “index factor”)

$25,000 x 2.47 = $61,750 (this is your indexed earning amount for 1985)

When moving on to compute your actual benefit amount, the SSA doesn’t use your actual earnings amount for those 35 years to come up with your benefit amount. It uses your indexed earnings amounts.

Hopefully we didn’t lose you in all the numbers there. We weren’t lying when we said it was a little more complicated than many realize.

We can’t say exactly when the SSA started calculating benefits with this index, but we can tell you the SSA has a NAWI for each year going back to 1951. That would suggest we’ve been calculating Social Security benefits this way for several decades.

Who knows what may have occurred with the “error” mentioned in your letter. Perhaps a computation error was initially made in indexing your earnings to arrive at your benefit amount. Lowering your monthly benefit may just be the frustrating result of correcting the error.

Concerning your “individual contributions,” Social Security benefit amounts have never technically been based on what you contribute. It’s based on your earnings. The SSA never looks at the exact individual amounts you contribute in payroll taxes. This may be what the letter was mentioning.

But rest assured, your contributions were absolutely considered when calculating your benefit amount. In looking at your earnings, the SSA IS considering about how much you would have contributed in payroll taxes. That’s why those who earned more in their 35 years and worked longer receive higher benefit amounts. They put more in for a longer time, so they take more out when they retire.

Again, sorry for all that math, but we hope it helped. Thank you so much for such a great question, and we hope you’re kicking back and enjoying retirement!

Thanks, Clarissa!

Do you have a question about your Social Security benefits or Social Security policy? Please give us a shout over at our contact page. We’d love to hear what you have to say and feature your question on our weekly “Ask The Seniors Center” blog post!