We decided to take a look at some of the internet’s most searched Social Security questions. Here are the top nine questions Americans ask about their Social Security benefits according to major search engines.

Are Social Security benefits taxed?

This is the #1 question people ask about Social Security. The answer is yes.

If you make over $25,000 in income ($32,000 for couples), a portion of your Social Security benefit will be taxed. Between $25,000 and $34,000 ($32,000 and $44,000 for couples), up to 50% of your benefit will be taxed. If your income is more than $34,000 ($44,000 for couples), up to 85% of your benefit will be taxed.

Your benefits may also be subject to state level taxes depending on what state you live in. Thirteen states currently tax Social Security income.

Are Social Security numbers reusable?

Not even once. Every Social Security number is entirely unique. And with nine digits, there are about one billion possible combinations. To date, we’ve only used around 450 million of them, so there’s no reason to be concerned about reassigning numbers anytime soon. When someone passes on, their Social Security number passes on with them.

Can my Social Security number be suspended?

Sounds like people have been getting some phone calls lately…

This Social Security question’s popularity is almost certainly due to the explosion of a phone scam telling people their “Social Security number has been suspended” in order to trick them into releasing their Social Security number and banking information.

Short story short: no. The Social Security Administration does not suspend Social Security numbers. Ever. For any reason. Anyone telling you the SSA can, will, or did suspend your Social Security number is lying to you. Ignore and report these instances and stop identity thieves in their tracks.

Can Social Security benefits be garnished?

Yes, they can. But it depends on the kind of debt we’re talking about. In most cases, Social Security income is protected from garnishment. Loan debt, credit card debt, and medical debt can’t be garnished from Social Security benefits.

However, Social Security income can be garnished to pay federal debts, such as tax debt, federal student loan debt, child support, court-ordered restitution, and alimony. Both Social Security and Social Security Disability Insurance can be garnished.

Supplemental Security Income is NOT subject to garnishment under any circumstances.

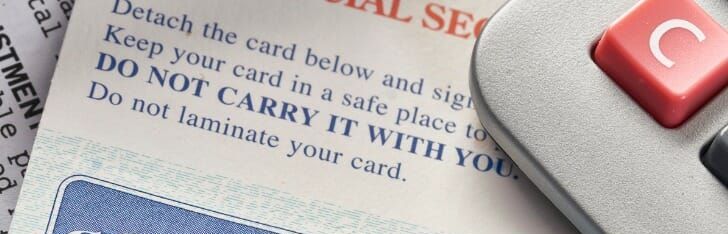

Can you laminate your Social Security card?

No, no, no, no! Do NOT laminate your Social Security card.

Yeah, yeah, we know. It really stinks to be expected to keep a flimsy paper card intact for your entire life. But we promise it’s for your own good. The same features that make your card a pain in the you-know-what to keep nice are also preventing your card from being illegally duplicated.

The Social Security Act requires the SSA to issue Social Security cards that can’t be counterfeited. While it may just look like ink on a crappy piece of cardstock to us, our cards are actually printed with pretty specialized techniques on very unique paper—not something a fraudster could easily duplicate.

By laminating your card, you block access to these security features and could damage your card. The SSA suggests you put an easily removable protective film over it instead.

It’s also worth noting that the best way to keep your Social Security card nice over time is to *not carry your Social Security card around with you.* You should be locking your card up somewhere safe when you don’t need it.

Will the Social Security Administration ever call you?

It is possible a representative from the Social Security Administration could call you, but it is extremely rare that they’ll ask for or require you to confirm personal information over the phone. In these cases, you’ll already be well aware that a SSA employee is going to be contacting you.

As with this whole “suspension” business, this questions’ search frequency is assuredly due to scam calling.

It’s much easier to know what the SSA WON’T call you about than what they might call you about, so keep these in mind:

The SSA will NEVER ask you for immediate payment.

The SSA will NEVER ask you for banking, identifying information, or payment information over the phone.

The SSA will NEVER ask you to pay a debt with no appeal process.

The SSA will NEVER ask you to pay to avoid being arrested or deported.

The SSA will NEVER ask you to pay a debt using a gift card or prepaid debit card.

How are Social Security numbers created?

Social Security numbers are generated using three number groups.

The first set of three numbers is kind of like an area code. It denotes the geographical area of the Social Security office that issued your number. Usually, this area will be close to the place you were born.

The second set of numbers is your group number. This is the order that you were assigned your number from a set of new applicants.

And the third is a serial number also reflecting your position in a set of applicants with your area code and group number.

As of 2011, the Social Security Administration abandoned this method for a more randomized number assignment.

How are benefits calculated?

We’ll leave this one to the experts:

“Many people wonder how we figure their Social Security retirement benefit. We base Social Security benefits on your lifetime earnings. We adjust or “index” your actual earnings to account for changes in average wages since the year the earnings were received. Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most. We apply a formula to these earnings and arrive at your basic benefit, or “primary insurance amount.” This is how much you would receive at your full retirement age — 65 or older, depending on your date of birth.”

The Social Security Administration offers a benefit estimation worksheet so you can ballpark your monthly benefit.

Are Social Security cards free?

They say nothing in life is free (and they’re probably right in this case if you want to take paying taxes into account), but the Social Security card issued to you at birth is gratis. The Social Security Administration provides Social Security cards at no cost. In fact, should you need a new or replacement Social Security card, you can request a free replacement right here at the Social Security Administration’s website.