Earlier this year, The Senior Citizen’s League (TSCL) hinted at a 0% Social Security cost-of-living adjustment (COLA) for 2021 in their May press release.

The Senior Citizens League

The Senior Citizens League TSCL later amended that projection in the following months.

We now know despite many groups’ initially alarming speculations, there WILL be a COLA of 1.3% beginning next year—certainly not great, but still a far cry from absolutely nothing.

But while we were all focused on potentially not seeing a COLA boost, many of us missed a far more concerning reality revealed in the release.

According to a recent TSCL study, seniors have lost as much as 30% of their purchasing power in the past twenty years.

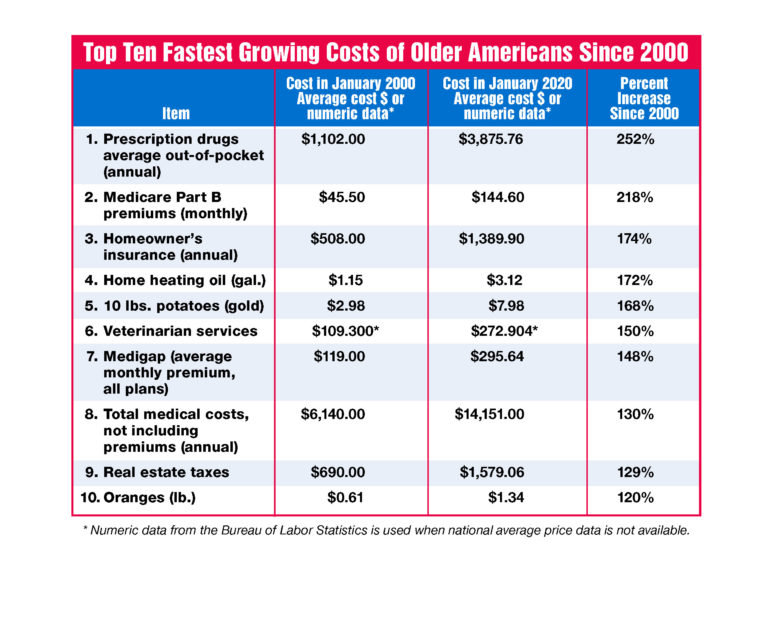

TSCL studied the prices of 40 household items between January 2000 and January 2020. Unlike the market basket of items used to determine the COLA, the 40 items chosen for this study were based on Social Security beneficiaries’ spending habits. It included items like Medicare Part B premiums, property taxes, and prescription drug out-of-pocket costs.

The study determined the cost of these critical items rose by 99.5%, with the most vital items, like housing, medical costs, and insurance rising the fastest.

Social Security benefits have only risen 53% during that same time period.

To illustrate this gap in real terms, this shortfall between benefit growth and rising prices means a senior who could buy $100 of groceries in 2000 can only afford $70 dollars of those groceries today.

This analysis provides us with mathematical certainty that benefits not only fall short of retirees’ actual living costs, but are falling shorter and shorter every year. The way we are calculating benefit increases is completely failing to keep up with the rising costs of most things, but particularly the things that impact seniors the most.

Though this information does make the case for an immediate COLA increase, such as some lawmakers are currently proposing, it’s far more important we consider this problem well beyond the (hopefully near) end of the pandemic. Increasing the COLA here and there would certainly be helpful to retirees right now, but this data shows we have a seriously outdated and inadequate system for determining benefit increases current day.