The 2023 COLA is welcome news for those on Social Security, but it also has implications for how much tax you’ll pay on your benefits. The COLA is determined by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which rose 8.7 percent in the 12 months ending September 30, 2022. That’s the largest increase since 1982.

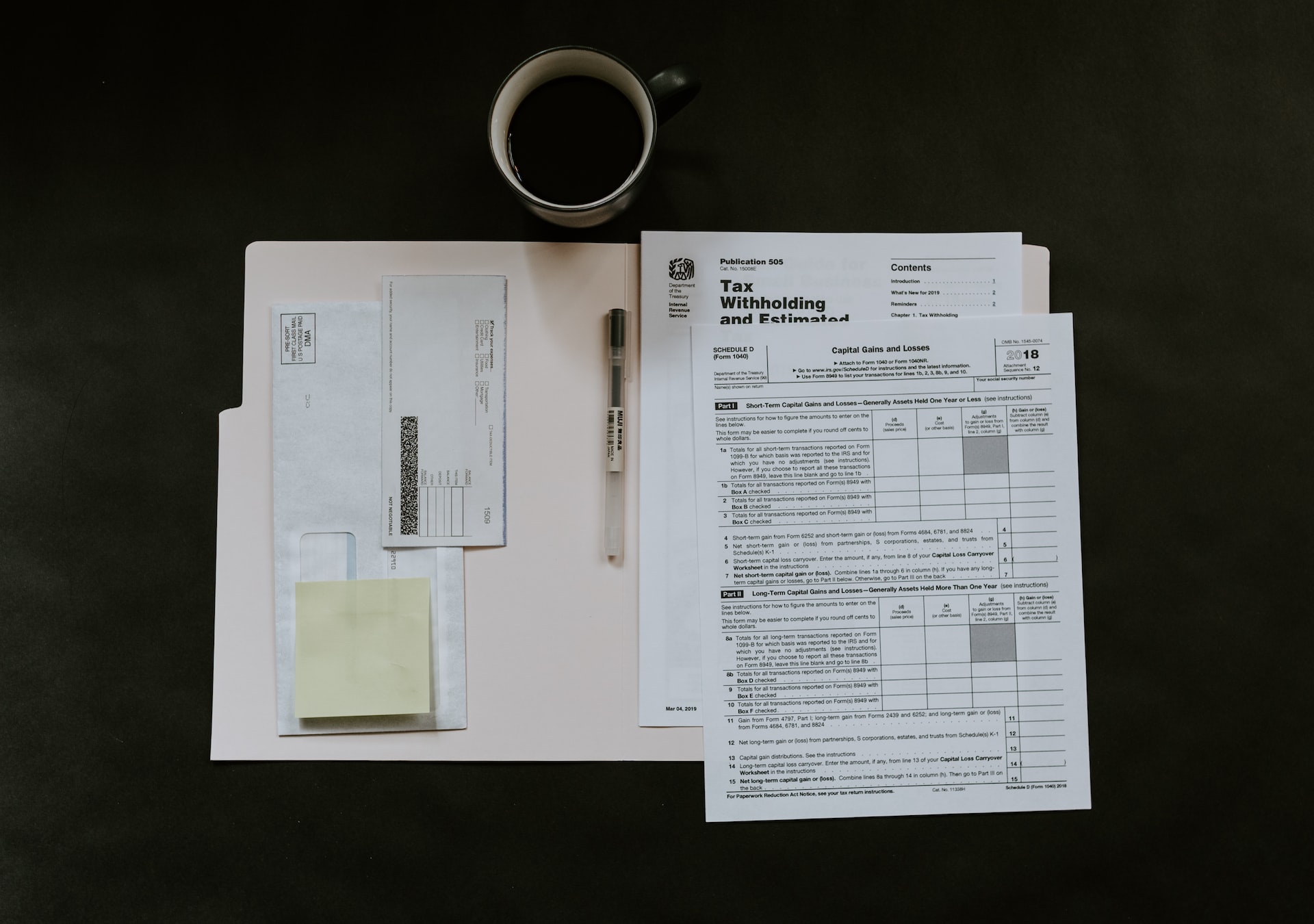

However, according to CNBC, this bump in income could also push some retirees into a higher tax bracket. Single taxpayers who make more than $25,000 a year and couples who make more than $32,000 a year are currently taxed on up to 50 percent of their benefits. If your income increases because of the COLA, you could be pushed into a higher tax bracket and end up paying taxes on up to 85 percent of your benefits.

While this news may be worrying for some, it’s important to remember that the COLA is still a positive development overall. In addition, there are steps you can take to minimize the impact of higher taxes on your benefits, such as contributing to a Roth IRA.

The Seniors Center is here to help you make the most of your retirement, from maximizing your Social Security benefits to finding the best retirement community for your needs. Follow us on Twitter and Facebook to learn more!