In an October survey of 1,173 workers, including active workers, unemployed workers, and workers in pandemic-related furloughs, Transamerica Center for Retirement Studies examined how Americans are planning for retirement amid economic uncertainty. It also took a look at how our collective pandemic experience has shaped workers’ views on a variety of retirement issues.

tcrs2020_pr_20th_annual_worker_compendium_press_releaseAmong several noteworthy revelations, the survey revealed MOST workers are suffering at least one negative effect from the pandemic, including those that directly impact their ability to save for retirement:

52% of respondents say their employment or income has been impacted by in at least one negative way, including furloughs, job loss, pay cuts, hour loss, or being forced into early retirement

33% of respondents say they have or are planning to take out loans or make a withdrawal from their retirement accounts to make ends meet

34% of respondents say paying off credit card debt is a financial priority

With so many workers saying they’ve suffered some kind of income loss—with a significant chunk needing to take on additional debt via loans and credit cards—the pandemic is causing a two-pronged retirement problem.

We’ve spent some time talking about how lost wages and unemployment are decreasing contributions to Social Security, impacting current day retirees, but we haven’t talked about what this means for future retirees.

It’s no secret the United States has had a retirement savings crisis for many years. According to the National Institute on Retirement Security, 40 million households own no retirement assets whatsoever. The median retirement savings account balance for those nearing retirement in the U.S. is just $14,500. And that was before any pandemic showed up to force those households to drain their savings early and force them to take on debt.

The added pressure of the pandemic means families are able to save even less for retirement, increasing the likelihood for many that they’ll need to rely on Social Security for most of their retirement income.

And in a situation where Social Security is on target to run dry by 2034, resulting in a 25% across-the-board benefit cut, that’s not good. If Congress doesn’t shore up Social Security’s funding by then, there’s almost no way these households could survive without some other kind of income.

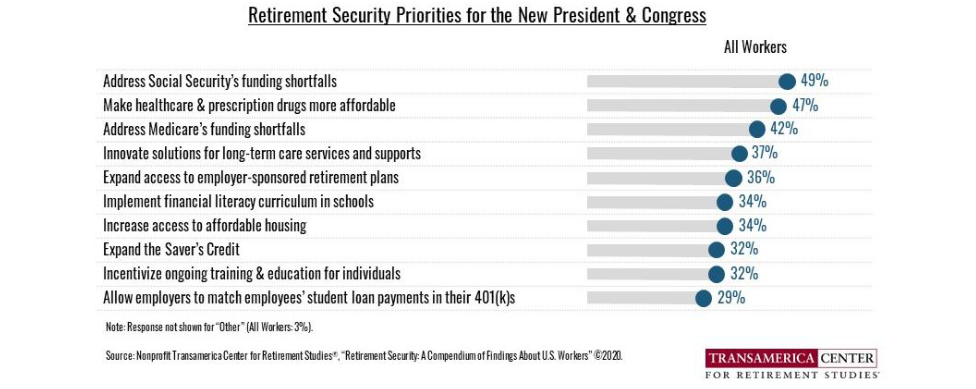

Because of this, the next survey finding comes as no surprise. TCRS also asked these workers to choose what they felt was the new Administration’s top retirement policy priority.

Respondents clearly favored three policy goals, with the most important being fixing Social Security’s long-term funding shortfall. Even against lowering the cost of healthcare and prescription drugs, typically the most discussed issue within the retirement security sphere, workers are clearly concerned about Social Security’s future. Rounding out the top three was also fixing Medicare’s long-term funding shortfall.

With so many households woefully lacking in retirement savings, it appears the number of those depending on Social Security and Medicare for the majority of their expenses will doubtlessly increase. And based on this survey’s results, the pandemic isn’t doing anything but assuring that increase. Workers who are experiencing financial difficulties right now are very clearly looking into the future and wondering what kind of position they’ll be in if Congress doesn’t act fast.