For the first time in four years, nationwide gas prices average below $2.00 per gallon, down $0.70 from last year.

This would be fantastic news for anyone planning a spring road trip, but…nobody is going anywhere anytime soon. If they were, we could probably expect fuel prices to make its seasonal climb well into the $2 range per usual.

But as we’re all cooped up in our homes, global demand for oil has disappeared in a matter of days. U.S. oil prices have dropped to a nearly two-decade low due to pandemic fears.

Depending on how long stay-at-home orders last—and how long it takes for oil usage and price to jump back up—this could become a problem for those on Social Security.

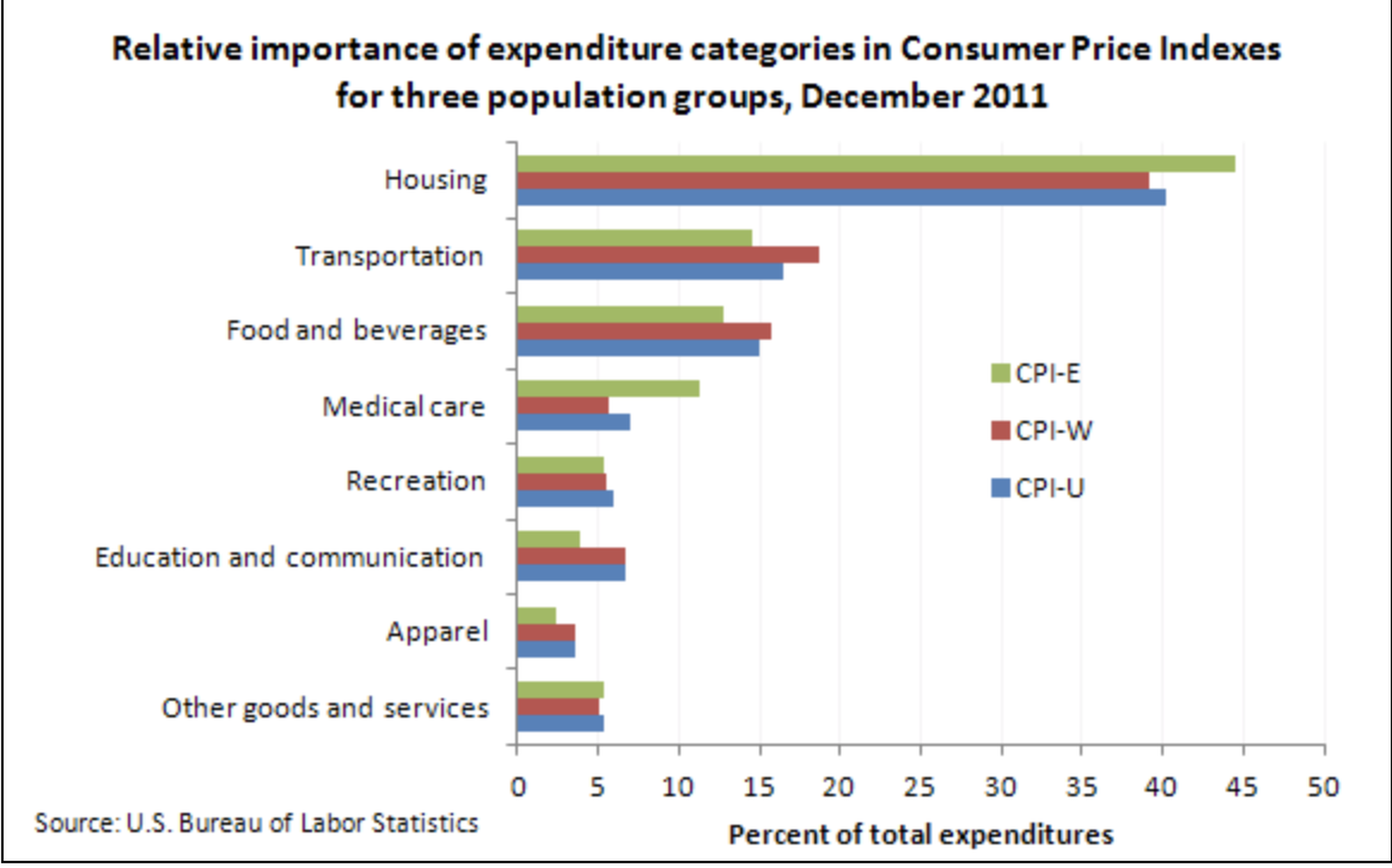

The CPI-W, the consumer price index currently used to calculate Cost-of-Living Adjustments (COLAs) for Social Security, is based on a market basket of goods and services most Americans purchase in their day-to-day lives. It includes healthcare, groceries, housing, recreational items and activities, and transportation. These items are weighted at different levels of importance according to how vital they are to citizens’ lives.

Using this market basket, the government tracks the general amount the public is spending to live their lives year to year. This is how we learn when, where, and how much inflation is happening. If, by around the third quarter, inflation is determined to have grown, the Social Security Administration will make the decision to raise COLAs for beneficiaries to counteract the pressures of rising prices.

This is all well and good, except the “W” in “CPI-W” stands for “worker.” That means items in the market basket are selected and weighted according to the spending habits of American workers, not retirees.

For the most part, retirees and workers need to buy the same things. But retirees and workers have vastly different lifestyles. Whereas a worker who commutes five times a week would have an increased need for fuel, a retiree—many of whom no longer drive—would not. This represents a major flaw when it comes time to calculate COLAs.

Gas prices factor pretty heavily in the CPI-W. Not only do workers use far more gas than seniors, but gas is an area that experiences a lot of inflation very quickly compared to some other essential goods. The annual price for gas tends to be a big indicator of what COLAs will look like when they’re announced in the fall.

Meanwhile, other areas that seniors rely on more, like medical care, are steadily rising in price.

What this all boils down to is a situation where beneficiaries’ actual cost of living may not really be reflected by the COLA announcement this fall. If gas prices continue to fall or remain low into third quarter, beneficiaries may receive low to no COLA for 2021. After all, gas prices collapsed—there was no inflation!

The effect of gas prices on Social Security COLA determinations has been a subject of criticism for many years. It is at best, inaccurate, and at worst, unfair to seniors that a product they use very little is such a force in determining the raises they need to cope with perpetually climbing medical costs.

And that’s in a completely normal situation. But in the year of COVID-19? Who can say what the cost of medical care and pharmaceuticals will look like as demand and shortages grow?

Our pandemic predicament has certainly been game-changing in more ways than one. In terms of disasters and how they can affect our whole society, we’ve never really seen anything like this—at least not in a very, very long time.

One of those ways is how effectively Coronavirus is testing and exposing the cracks in nearly every single one of our systems. If there is a flaw in our public services or social programs, trust and believe this illness will lift the curtain hiding it—if it hasn’t already.

“Flaw” is the least of the things seniors advocacy groups have called the current formula for calculating COLA increases. There have been calls to switch to using the more appropriately designed CPI-E (elderly) going back many years.

The CPI-E is a still experimental calculation formula designed with the spending habits and purchasing power of retirees in mind. It was developed with the understanding seniors don’t buy the same things in the same amounts as other demographic groups. It places special emphasis on healthcare spending, noting that adults over age 62 spend twice as much on prescription drugs and medical services than other age groups. It also recognizes that—like gas–healthcare costs rise very quickly compared to other market basket items.

While the CPI-E isn’t a fully fleshed-out index and has never been tested in the wild, the SSA estimates adopting the CPI-E would reliably increase Social Security COLAs by 0.2 percentage points.