In an effort to clear up confusion caused by initial announcements, the U.S. Treasury has released additional information about upcoming COVID-19 relief payments regarding retirees and those who did not file income tax returns for the past two years.

Perhaps in seeking to speak directly to affected workers, the Treasury initially issued statements that relief payments would be issued automatically based on Americans’ 2018 and 2019 tax return data. This set off alarms for beneficiaries and retirees who often don’t file tax returns.

Generally speaking, those whose only major source of income is Social Security aren’t required to file tax returns. More broadly, this group also includes those whose yearly income doesn’t exceed the standard deduction for single filers (in 2019, that amount is $12,200).

Of course, this is only a generalization. There are a host of rules and exceptions that determine who needs to file a return and when different types of income are taxable. If you’re interested in the exact rules for non-filing, Intuit offers a nice breakdown right here.

This announcement was welcome news to workers experiencing lay-offs and pay stoppages, but in trying to reassure them help was on the way, the Treasury forgot workers aren’t the only ones experiencing hardship right now.

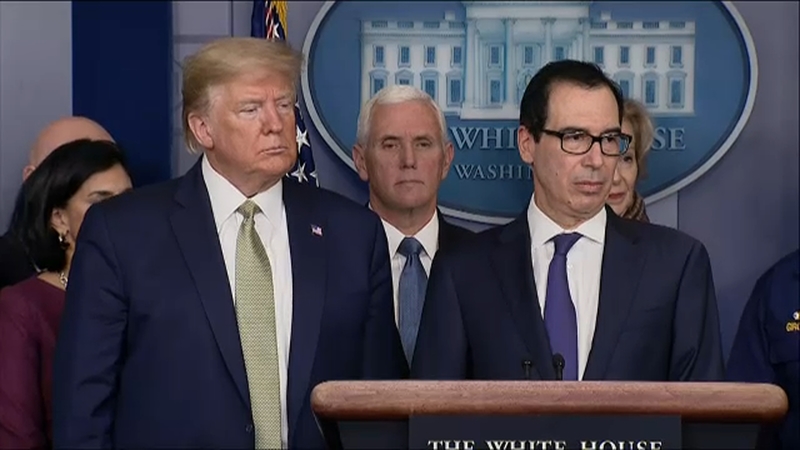

Thankfully, the Treasury and IRS have stepped up to clarify earlier statements about tax returns.

While it was suspected by many that beneficiaries would have to file some kind of 2019 return or aplication, it seems payments to beneficiaries will be fully automatic. The Treasury has made an official press release specifically concerning how retirees will receive their payments.

In summation, Social Security beneficiaries who don’t ordinarily file tax returns will NOT need to file or fill out any special application to receive their payment.

Instead, the IRS will use the SSA-1099s and RRB-1099s already on file to automatically generate and send either a paper check or direct deposit payment. Whether or not you receive a paper check or direct deposit will depend on how you already receive your Social Security benefits.

The important takeaway is you do not have to do anything to receive your economic impact payment. If you’re receiving Social Security benefits and eligible for the payment, the IRS has everything it needs to send you your payment. It will be handled the exact same way as your Social Security benefit.

\

The Treasury and IRS have indicated that these payments are intended to go out by next week.