We often talk about how important it is for seniors to get higher Social Security payments. Specifically, we talk about the importance of high Cost-of-Living Adjustments (COLAs).

While the amount is a crucial topic, there’s another way to view this situation. We must also consider the buying power of Social Security. If inflation and rising prices become too big of a factor, even high COLAs can fall short.

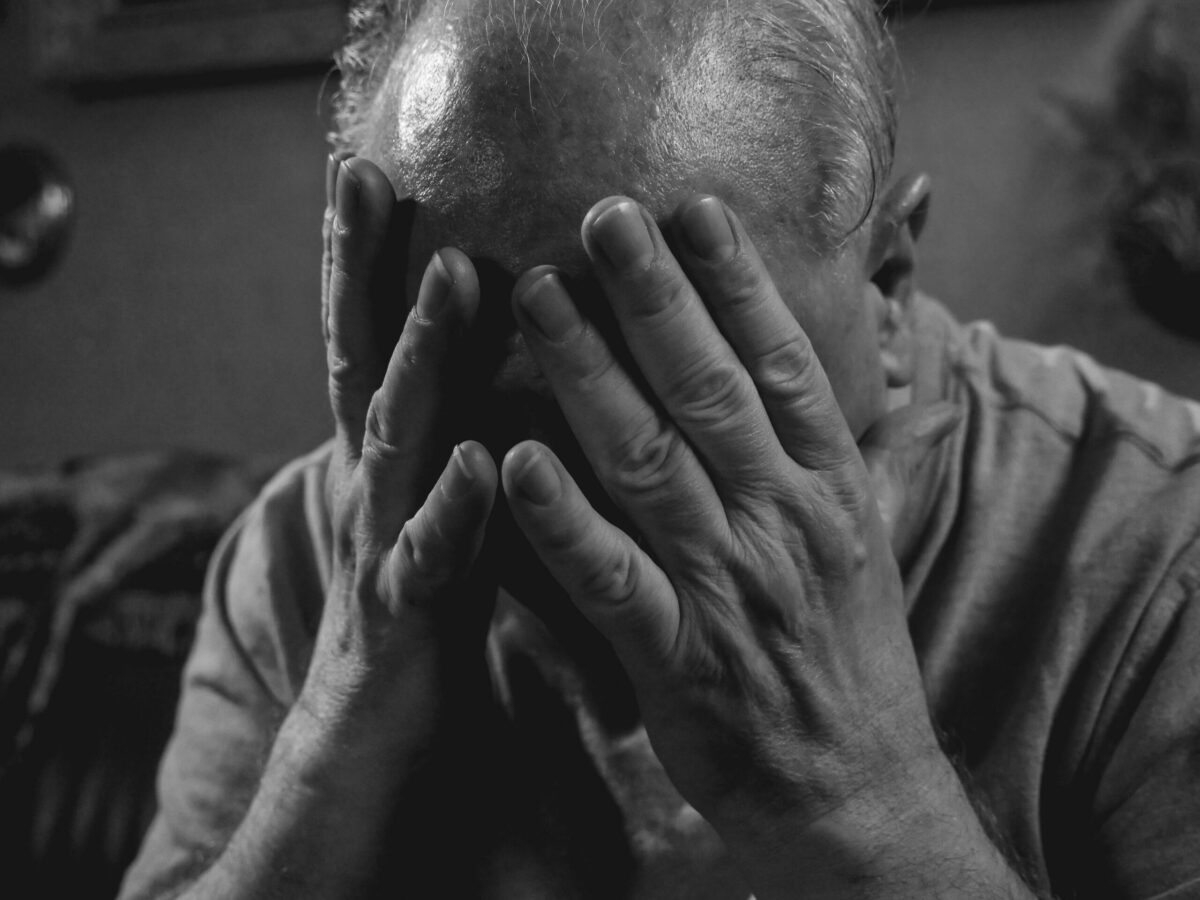

Social Security benefits have lost about 20 percent of their buying power in recent years! In some ways, this is the same as having a piece of legislation wipe out one-fifth of the benefits recipients have fairly earned.

Also consider how costs like housing, healthcare, and groceries have risen in recent years. This creates a larger gap between the money seniors have and the amount they need to live comfortably. What are your thoughts on Social Security’s buying power?

Help The Seniors Center Protect the Future of Social Security

The Seniors Center is committed to finding solutions to strengthen and protect the Social Security Trust Fund. Social Security is a contract between citizens and the government. Money deposited in the Trust Fund should only be used to pay benefits to eligible recipients.

The Seniors Center is demanding Congress finally put a stop to the careless borrowing and spending by greedy politicians that has put our Trust Fund and our secure retirement in jeopardy.

At The Seniors Center, our goal is to help seniors, and we’re doing that by protecting the future of Social Security. Retirees shouldn’t have to worry about losing their hard-earned benefits to taxes or the agendas of greedy politicians. If you agree, we invite you to sign our petition today! And follow The Seniors Center on Twitter and Facebook for more updates!