Here we go again.

In a political standoff that’s become all too familiar for Americans since the 1980s, our federal government is just days away from yet another government shutdown.

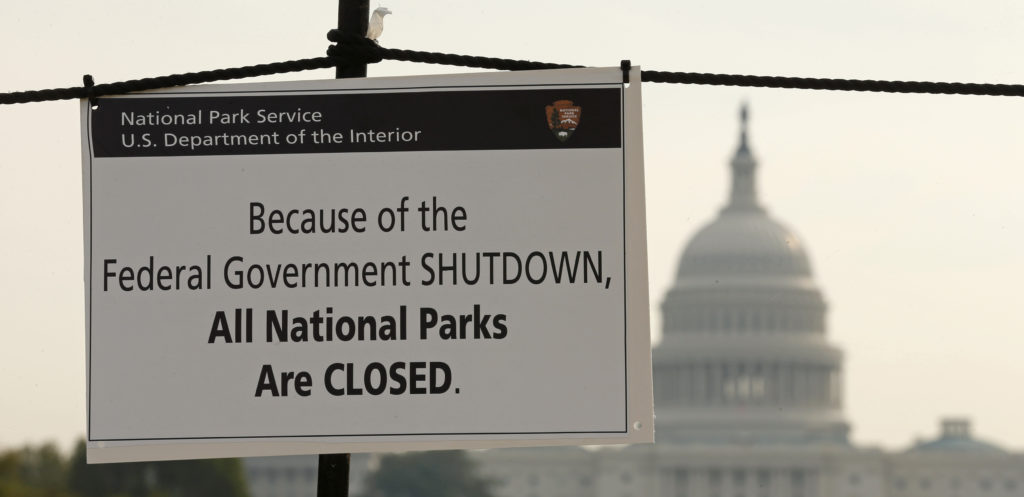

This time, Congress’ deadline to pass a federal spending bill is January 19th–this Friday. A failure to meet this deadline may result in the closure of many federal departments, agencies, and federally operated parks and facilities, the furloughing of federal employees, and some federal programs being brought to a standstill.

In other words, with no spending bill there’s no funding. And without funding, many parts of the government will just shut down.

The policy disagreement at the heart of this next potential shutdown has to do with several programs on which the parties can’t come to consensus, including funding for the Childrens’ Health Insurance Program (CHIP) and the Deferred Action for Childhood Arrivals program (DACA).

Republicans and Democrats are so divided on issues of immigration in particular that it looks very likely we’re headed for our first shutdown since the government shuttered its doors over the Affordable Care Act in 2013.

With a shutdown looming and the closures of 2013 not all that far in the rearview, millions of seniors are wondering how such a shutdown might affect their retirement benefits–benefits administered by a federal agency.

If you’re concerned a government shutdown might mean you won’t receive your Social Security payments, you can breathe easy–if you’re already enrolled and receiving your benefits, you should continue to receive them as you always have.

Since Social Security is mandatory and self-funded, it doesn’t require federal spending authorization. Your benefits will be paid from funds contributed by millions of workers specifically for this purpose. Other programs funded by federal taxes may come to a pause while a spending bill is worked out, but Social Security can function independently to pay benefits during a shutdown.

However, Social Security isn’t completely immune to a government shutdown. Employee furloughs at the Social Security Administration could slow or disrupt services, including applications and appeals for SSDI. Those looking for assistance with their benefits could experience long waits and general frustration trying to get the answers to their questions.

In short, the benefits you’ve come to plan around and depend on? They should be just fine in the event a spending compromise can’t be reached. No need to panic!

But Social Security beneficiaries paid for far more than just their benefits when they contributed to the Trust Fund–they also contributed to have reasonable access to vital Social Security services, advice, and information. Seniors are as entitled to reasonable waits, good customer service, and help from SSA employees as they are their benefits. After all, their payroll taxes funded all of those things.

Though historically, Congress makes last minute moves to avoid shutdowns, it remains to be seen what will happen on Friday.

But should partisan bickering result in a spending freeze that complicates beneficiaries’ ability to access the Social Security services they’ve earned, every senior has a right to contact their congressmen and congresswomen to demand answers and action.