We recently sent a survey to about 300,000 The Seniors Center supporters to get their thoughts on a variety of issues affecting Social Security today. Our members aren’t exclusively seniors, but the vast majority of these responses were given by Americans over the age of 62 and current Social Security beneficiaries.

We asked our members for their opinions on the latest Social Security reform bills, how Social Security is funded, and potential measures Congress might take the closer we get to reserve depletion.

Of the thousands of responses we received, we selected 100 responses at random to create a sample size that could give us a quick and basic idea how our supporters feel about these issues.

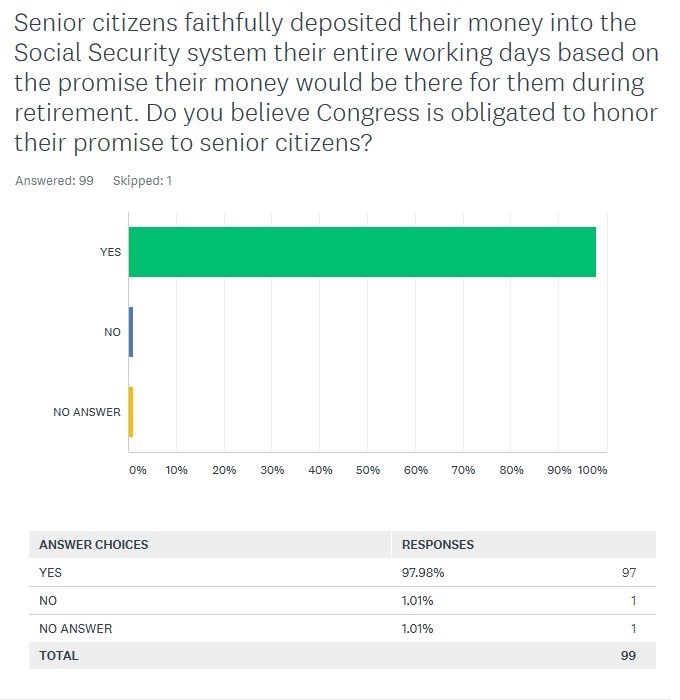

Here are just a few of the questions we asked along with the responses from our sampling:

Seniors are entitled to their Social Security benefits

It comes as no surprise retirees feel complete ownership of their retirement benefits. Social Security was designed at the outset to make Americans feel that way. At a time when many would have viewed receiving Social Security negatively, the Roosevelt Administration heavily pitched the program as an earned insurance benefit—NOT a handout for those seen to be weak or needy.

Today, absolutely no one needs to be convinced they’ve earned their benefits. Americans entering the workforce today may be the third or fourth generation of their family who has contributed to Social Security. Americans today have contributed trillions of dollars to Social Security for nearly 86 years.

And while we know Social Security is backed by the full faith and credit of the United States and has never “missed” paying its obligations, the federal government can exercise its ability to tax, reduce, or remove those benefits at any time (meaning it’s not much of an “obligation” at all). If you’ve ever wondered how Congress can alter benefits that we’ve all paid for by law, it may surprise you to know there’s Supreme Court precedent affirming Congress’ right to do all those things.

Despite this fact, all workers tend to view the mandatory collection of payroll taxes in return for retirement benefits as a promise Congress has made to them. It doesn’t seem very fair that we have no choice in contributing if Congress isn’t legally required to give us what we’ve contributed.

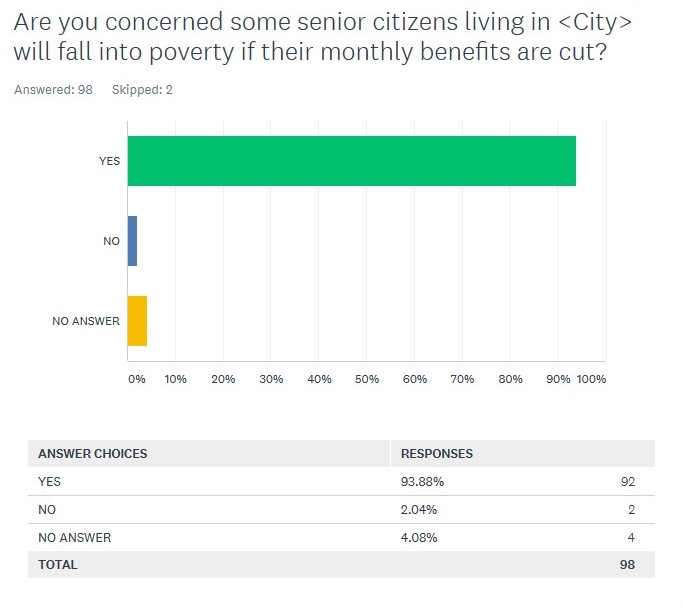

Senior poverty is a growing concern among retirees

As many as 40% of all beneficiaries rely on Social Security almost completely for their retirement income, and the average yearly benefit amount is $18,170 per year. For many, even if benefits aren’t reduced in the future to close Social Security’s funding shortfall, poverty is already a daily reality.

But today this benefit is just enough for a single beneficiary to tiptoe on the federal poverty line. Any future benefit reductions that might occur as the result of Social Security’s funding problems going unaddressed would assuredly push those beneficiaries over the baseline.

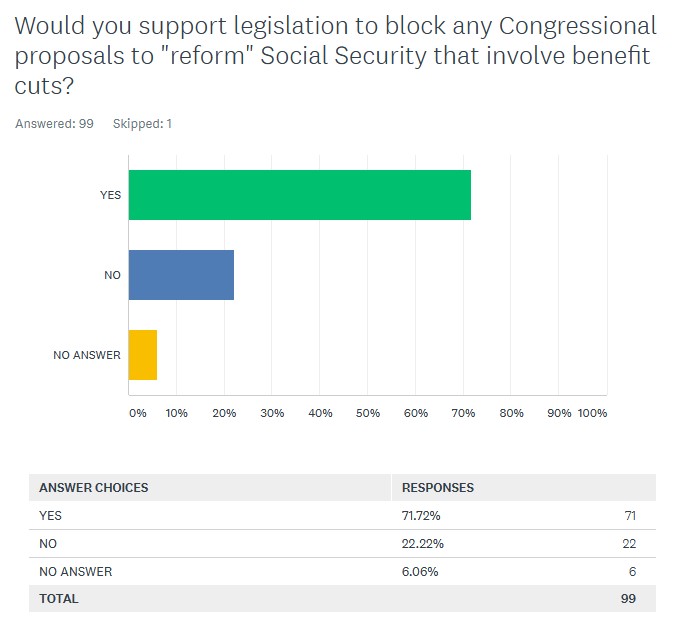

Seniors do NOT want benefit cuts to be the solution to Social Security’s funding woes

Given the all the information above, the strong response to this question is expected. Almost no one wants Social Security benefit cuts to be legislatively possible, both because we had no choice in paying for them and because doing so would inevitably impoverish millions of hard-working people.

Interestingly, far more supporters answered to the contrary of the majority on this one than the two previous. Nearly a quarter of those we surveyed do NOT want to see Congress prohibited from cutting benefits.

Knowing our supporters, we can make some educated guesses about why that might be.

In past online polls, our members supported ideas such as raising or eliminating the tax cap on payroll contributions. While doing so wouldn’t directly reduce anyone’s benefits, it WOULD increase the amount of payroll contributions the wealthy make. Since there is an absolute maximum benefit amount, these contributors would be contributing FAR more in payroll taxes than they could ever receive comparable Social Security benefits for. In a way, that could be perceived as “reduced” benefits for them.

There is also a significant amount of our membership that supports means-testing benefits, a policy that would reduce Social Security benefits for those earning higher levels of income.

This quarter of respondents could be thinking about both of those policies. They may be in favor of benefit reduction strategies specifically targeting very high earners.

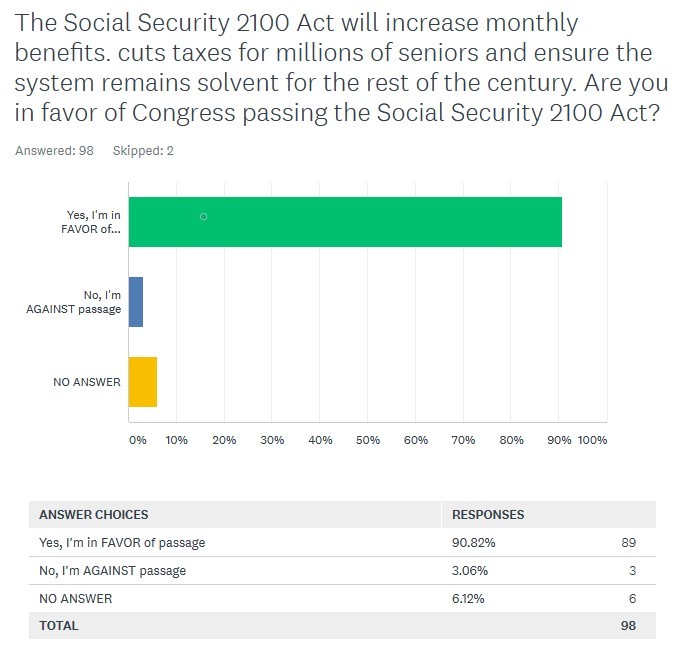

Seniors overwhelmingly support the Social Security 2100 Act as a solution to closing Social Security’s funding gap

Given the sentiments expressed in the previous questions, it’s no wonder why our members like the Social Security 2100 Act. This is a bill that uses a suite of policies that are very popular with both our members and the general public to expand benefits and significantly extend solvency.

Among the strategies included in the 2100 Act are across the board benefit increases, especially for those who tend to have the smallest benefits, an increase in payroll tax contributions instead of benefit reductions on retirees as a means of increasing Trust Fund income, and raising that maximum taxable wage cap for high earners. The net effect of this suite of policies would be to regain 75 years of solvency.