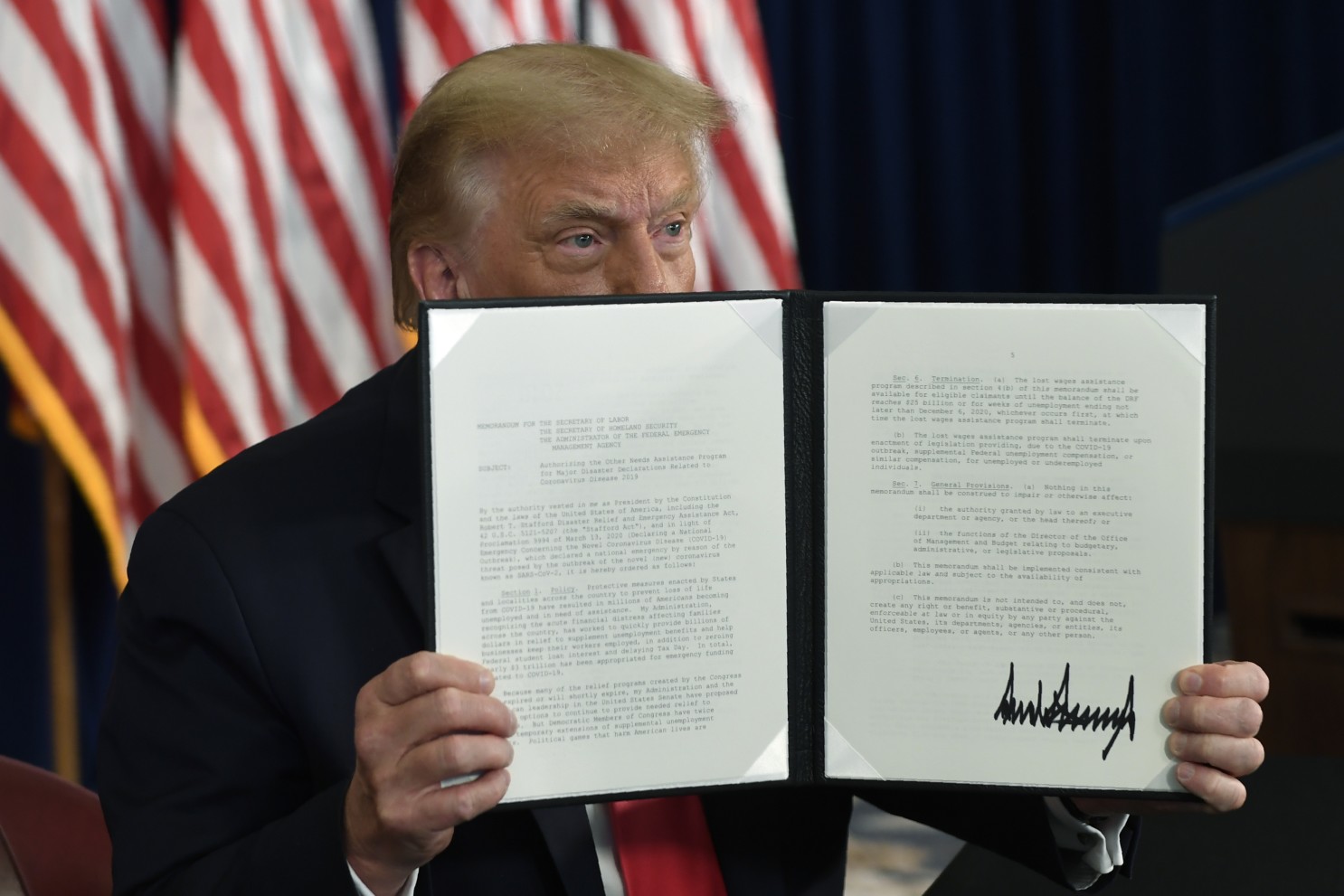

On August 8, President Trump announced his latest plan for COVID-19 recession relief.

In a move to put more money in working Americans’ pockets, Trump signed an executive order directing the Department of the Treasury to delay collecting employee-side payroll taxes through the rest of this year. This would apply to all workers earning less than $100,000 per year.

In addition, Trump revealed a new campaign promise and second term goal should he win the Presidential Election this November: he vows to completely forgive all deferred payroll taxes resulting from this new executive order and permanently end the payroll tax.

This is not the first time Trump has expressed his preference for payroll tax cuts over issuing direct stimulus payments. But in a truly shocking announcement, he has not only promised payroll tax cuts if re-elected, but also promised to terminate them completely and indefinitely.

This proposal would defund Social Security.

Following public outrage and condemnation from Social Security advocates, Treasury Secretary Steve Mnunchin clarified the President’s proposal. According to Mnuchin, Social Security would continue to be funded via automatic contributions from the general fund.

If that’s true, it would mean Social Security would continue to exist and continue to pay some kind of benefits to retirees, but it would no longer look anything like the program that has existed for the past 85 years.

One of Social Security’s founding principles was to be an earned retirement benefit. The pay-as-you-go funding mechanism, FICA or “the payroll tax,” was designed to make Social Security self-supporting and give beneficiaries a sense of ownership over their benefits. This defining feature of the program is what has always made it a bipartisan success story.

But by eliminating FICA and making Social Security one more line item on the federal budget, Social Security can no longer be earnestly called a retirement insurance program. The trillions of dollars workers have already contributed to the Trust Fund would disappear into the general fund. And there would be no funding mechanism in place to make sure Social Security always had money to pay beneficiaries.

In short, Social Security would no longer be a trust. It would be a welfare program. The exact thing its founders didn’t want it to be.

This is one of the worst Social Security policy proposals we’ve ever seen.

Social Security advocates have noted time, and time, and time, and time again that the Trust Fund is headed toward disaster. We are already facing a massive payroll tax funding shortfall depleting what little reserves the program has left. And with COVID-19 causing mass business closures and unemployment, the rate of that depletion is only speeding up. With this added pressure on Social Security, some experts project we could exhaust the Trust Fund in as little as eight years.

Ending the payroll tax and cutting off Social Security’s only source of funding is the exact OPPOSITE of what we should EVER be considering at a time like this.

Not only is this a horrendous move for Social Security, but it doesn’t even hold up as a stimulus measure. Payroll tax cuts will ONLY help those who are still working in this recession. They won’t apply to anyone who is retired or has lost their job. These are the people who are most at risk right now.

Even if payroll taxes are only ever deferred and not cut, many employers will still choose to withhold payroll taxes for their employees to protect them when the tax bill comes due. Employees may not ever see a single dime of this cut. All it will do is prevent Social Security contributions from making it into the Fund and into the pockets of beneficiaries.

But the worst of this proposal is the loss of security beneficiaries would experience. The “security” in Social Security is the entitlement workers feel when they’ve contributed a portion of their own earnings toward benefits they’ll receive later. That is the contract the American people have made with the government.

Should Social Security become a general budget item, what happens to that contract? With no dedicated source of funding and no direct investment being made toward those benefits, how “secure” and assured are those benefits, really? Does Social Security become another federal program subject to cuts, budget adjustments, and recessions just like anything else?

And what about the millions of people that have put so much money already into the Trust Fund? Where will what’s left of that money go? And how are they supposed to feel when they’ve contributed so much…and then one day it doesn’t matter anymore?

The President reiterated his commitment to “not touching” Social Security and protecting the program. He insists that though he aims to move Social Security’s funding obligation to the general budget, the program will be protected.

But we fail to see how promises to terminate the payroll tax constitute anything other than “touching” the program. It’s something that would fundamentally change the program and how Americans view it.

As as for it being protected? There is no greater financial protection than a program having its own dedicated source of revenue. If that was gone, it would be a social program competing for funds with all the others. Not to mention, there would be no more interest from contributions going into Social Security, either.

Where is the protection here?

There is none.